¿cómo funciona bonddia en cetes directo?

Bondes

Es posible realizar compras y ventas directas, así como operaciones de recompra, además de operaciones de préstamo de valores. Los CETES también pueden utilizarse como activos subyacentes en los mercados de derivados (futuros y opciones).

No obstante, hay otros temas que debes conocer, entre ellos, cuál de las opciones para depositar tus ahorros que puedes encontrar en el Mercado Mexicano tiene la mejor relación seguridad/rendimiento (yield).

1. Son muy seguros. Los Certificados de la Tesorería de la Federación (CETES) son uno de los instrumentos que el gobierno emite para financiarse, y a cambio ofrece una tasa de interés cobrable al final de un plazo determinado.

Aún con esta característica, es importante que conozcas cómo operan los CETES y así poder adquirirlos con el plazo que mejor se adapte a tus necesidades. Esto reducirá en gran medida la probabilidad de que incurras en una pérdida.

«El instrumento te dará un rendimiento a lo largo del tiempo y a la fecha de vencimiento recuperarás el monto de tu capital invertido. Sin embargo, y a modo de ejemplo, si invirtiera en un bono a 10 años y necesitara recuperar su dinero antes del vencimiento del mismo, se vería obligado a venderlo a un precio que podría ser inferior al precio al que lo compró, dependiendo de las condiciones del entorno económico que se presenten al llevar a cabo dicha decisión, y en cuyo caso podría, de hecho, experimentar una pérdida», explica la web de CETES DIRECTO.

Dinn

If you have never invested in your life, learning how to invest in CETES Directo is a great idea. It is a very good alternative to start in the investment world because it is easy, fast and very safe.

This means that the interest rates are also relatively low compared to other investment alternatives, more or less the same as the inflation rate. So, putting your money here will allow you to at least keep your money from losing purchasing power over time. In practical terms, it is very similar to investing in UDIS.

If you have money under your mattress (or in a big bank that pays you very little or almost no interest, which is almost the same thing) and you don’t want to take risks with your capital but you don’t want it to continue losing value due to inflation, investing in CETES Directo may be for you.

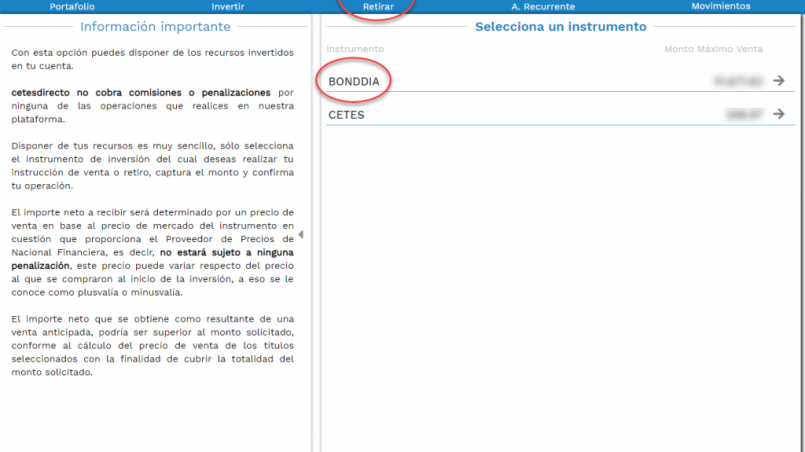

The CETESDIRECTO program allows you to manage your account in real time comfortably from any computer with internet access, by phone or mobile devices; by these means you will be able to acquire the different Government Financial Instruments that are available to you and are: Cetes, Bonds, Bonds and Udibonos.

Financial kubo

The Certificados de la Tesorería de la Federación (Cetes, for its acronym in Spanish) are a stock market debt instrument, which are issued exclusively by the Federal Government. This means that they are backed by the State. They are useful for both the issuer and the purchasers. On the one hand, they serve the government to raise money. On the other hand, they generate a return for those who buy them.

In order to simplify the purchase of bonds, NAfi created Cetesdirecto, a platform that allows these transactions to be carried out without intermediaries such as banks or brokerage firms. Thus, users can purchase government securities through the internet and without paying commissions. Since its creation, the web portal has served more than 400,000 customers. Among its advantages are the following:

¿cómo funciona bonddia en cetes directo? en línea

I opened an account in Cetes Directo and CONDUSEF offers a guide for those interested. The process was easy for me, I signed through the advanced electronic signature of the SAT, and so I did not have to go to the nearest Bansefi (with coverage of the Cetes Directo plan) and I only had to click on «accept» and that was it, my account was created.

I wondered if the program will eventually cause the amounts requested by private banks to initiate an investment in Cetes to change. I hope so, since for now the banks are conditioning us to offer us the Cetes rate in exchange for investing large amounts of money, and Cetes Directo allows us to access the Cetes rate for only $100 pesos.

Perhaps it is a bit of a question of needing computer skills (or time to generate purchase orders over the phone) to manage a Cetes Directo account, although the truth is that it is easy to operate; you even need to understand a little about each type of government security offered on the portal. And yes, there are four of them and this allows, if you are interested, to build a portfolio.